For millions of student loan borrowers, the Aidvantage Navient Portal serves as their financial lifeline. This online platform provides access to crucial information and tools for managing federal student loans.

Whether you’re seeking to understand your repayment options, make payments, or simply track your progress, the Aidvantage Navient Portal is your one-stop shop.

The Aidvantage Navient Portal is a user-friendly online platform managed by Aidvantage, one of the largest servicers of federal student loans in the United States.

In 2021, Aidvantage acquired Navient’s federal student loan servicing rights, bringing together millions of borrowers under one roof.

This portal offers a centralized hub for borrowers to manage their loans, access resources, and connect with customer support.

Federal student loans are a significant financial burden for millions of Americans. With outstanding student loan debt exceeding $1.7 trillion, navigating repayment can be overwhelming.

The Aidvantage Navient Portal aims to simplify this process by providing borrowers with a clear and accessible platform to manage their loans effectively.

Aidvantage Navient Portal

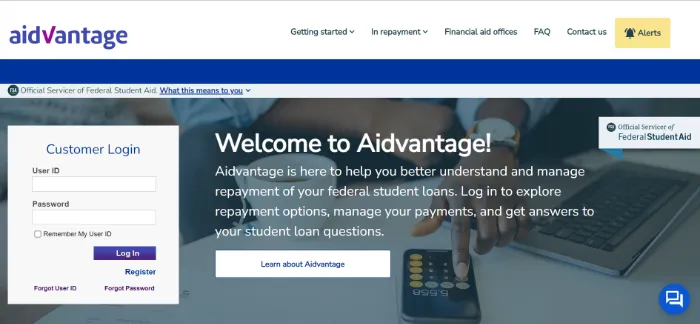

For a platform catering to millions of users, a user-friendly login system is crucial.

The Aidvantage Navient Portal prioritizes simplicity, offering a straightforward login process with clear instructions and readily available support options.

Step-by-Step Guide:

- Navigating to the Login Page: Visit the official Aidvantage website (https://myaccount.aidvantage.com/) and click on “Log In” in the top right corner.

- Entering Credentials Securely: Enter your User ID and password in the designated fields. Remember to keep your login credentials confidential and avoid accessing the portal on public computers.

- Two-Factor Authentication (2FA) for Enhanced Security: For added security, Aidvantage offers optional 2FA through a text message or email verification code. This extra layer of protection helps safeguard your account against unauthorized access.

Understanding the Aidvantage Navient Portal

Once logged in, you’ll be greeted by a personalized dashboard displaying your loan information, including:

- Loan balances and interest rates

- Repayment plan details

- Payment history and upcoming due dates

- Options for making payments

- Resources and tools for managing your loans

Highlighting Positive Aspects

The portal is accessible from any device with internet access, making it convenient for borrowers to manage their loans on the go. Information is presented in a clear and organized manner, making it easy to find what you need.

The portal provides information on various repayment plans and allows borrowers to easily switch between them.

Borrowers can communicate with customer service through the portal, ask questions, and seek assistance.

Addressing and Learning from Negative Reviews

Despite its positive aspects, the Aidvantage Navient Portal has received some negative reviews from users. Common concerns include:

- Technical issues: Some users have reported experiencing occasional technical glitches or difficulties accessing the portal.

- Customer service wait times: Long wait times for customer service representatives have been a source of frustration for some borrowers.

- Limited educational resources: While the portal provides basic information, some users have expressed a desire for more in-depth educational resources on loan management.

Aidvantage actively monitors user feedback and strives to address these concerns. By acknowledging and learning from negative reviews, they can continuously improve the portal and enhance the user experience.

Continuous Improvement

The Aidvantage Navient Portal is constantly evolving, with new features and functionalities being added regularly. User feedback plays a crucial role in this development process.

By incorporating borrower experiences into future updates, Aidvantage can ensure that the portal remains a valuable and user-friendly tool for managing federal student loans.

Understanding Aidvantage Navient

Aidvantage is a leading servicer of federal student loans in the United States. They work on behalf of the Department of Education to manage and collect payments on behalf of borrowers. Their services encompass:

- Loan processing and servicing: This includes managing loan applications, disbursing funds, processing payments, and tracking loan balances.

- Repayment options and assistance: Aidvantage helps borrowers understand and choose the right repayment plan based on their individual circumstances. They also offer assistance with deferment, forbearance, and other hardship options.

- Account management and communication: The Aidvantage Navient Portal provides borrowers with 24/7 access to their loan information, umożliwia them to make payments, update contact information, and communicate with customer service representatives.

- Educational resources: Aidvantage offers various educational resources to help borrowers understand their loans, manage their finances effectively, and plan for the future.

Beyond Traditional Systems

Unlike traditional financial aid systems, which often involve complex paperwork and limited online access, the Aidvantage Navient Portal offers a streamlined and user-friendly experience. Key features that make it stand out include:

- Centralized platform: All your loan information is readily available in one place, eliminating the need to manage multiple accounts or track down documents.

- Accessibility: Manage your loans anytime, anywhere with internet access, from your computer, tablet, or smartphone.

- Transparency and clarity: Information is presented in a clear and concise manner, making it easy to understand your loan terms, repayment options, and progress.

- Security: Robust security measures ensure the safety of your personal and financial information.

- Self-service options: Make payments, update your information, and access resources without needing to contact customer service.

Aidvantage-Navient Acquisition: A Closer Look

In 2021, Aidvantage acquired the federal student loan servicing rights from Navient, consolidating millions of borrowers under one roof.

This acquisition aimed to create a more efficient and streamlined system for managing federal student loans.

Impact on Users and Stakeholders

The acquisition brought both positive and negative implications for users and stakeholders:

For borrowers:

- Potential benefits: Streamlined loan management, improved customer service, and access to additional resources.

- Potential challenges: Adjustments to a new platform, concerns about data privacy, and potential changes in loan servicing practices.

For stakeholders:

- Increased efficiency: Potential for cost savings and improved loan performance.

- Scrutiny and oversight: Increased regulatory scrutiny and pressure to improve borrower experience.

Navigating the Post-Acquisition Landscape

The Navient Portal has transitioned to the Aidvantage Navient Portal, retaining most of its functionalities and features.

Borrowers with existing Navient loans can access their information and manage their accounts through the new portal.

Aidvantage Navient Phone Number: Your Lifeline to Support

Even with a user-friendly platform, challenges and questions may arise. Having accessible customer support is crucial for resolving issues and getting the help you need.

The official Aidvantage Navient phone number is 1-800-723-2773. They are available Monday through Friday from 8:00 AM to 8:00 PM Eastern Time.

Addressing Common Issues:

Some common issues borrowers might encounter include:

- Making payments: Understanding payment options, troubleshooting payment processing issues, and resolving payment errors.

- Changing repayment plans: Exploring different plan options, understanding the implications of switching plans, and completing the necessary steps.

- Hardship assistance: Applying for deferment, forbearance, or other hardship programs.

- Technical difficulties: Troubleshooting login issues, navigating the portal features, and reporting technical glitches.

Tips for Efficient Communication

Have your loan account information and any relevant details ready before calling. Explain your issue clearly and directly. Wait times can vary, so be prepared to hold for a representative.

Don’t hesitate to ask clarifying questions to ensure you understand the information provided. Keep track of important information shared by the representative

Aidvantage Navient Lawsuit

Aidvantage, as the successor to Navient’s federal loan servicing business, hasn’t faced major legal challenges specific to its operations.

However, Navient, its predecessor, faced several lawsuits alleging predatory lending practices and mishandling of federal student loans.

Details and Progression

One prominent lawsuit involved 39 state attorneys general accusing Navient of:

- Predatory lending: Targeting students with risky loans they couldn’t afford.

- Misleading practices: Providing inaccurate information about repayment options and forgiveness programs.

- Improper debt collection: Aggressively pursuing borrowers even during hardship situations.

Though Navient denied the allegations, they reached a $1.85 billion settlement in 2022. This settlement included:

$1.7 billion in private loan forgiveness for over 66,000 borrowers. $145 million to the states involved in the lawsuit.

$95 million in restitution payments to federal loan borrowers placed in specific forbearance plans.

Impact and Reputation:

The lawsuit and settlement raised concerns about transparency and fairness in student loan servicing. While the settlement provided relief to some borrowers, it also highlighted systemic issues in the industry.

Aidvantage has stated its commitment to ethical practices and transparency. They continuously update their policies and procedures to ensure compliance with regulations and address concerns raised by the lawsuit.

Aidvantage Navient Login App

Recognizing the growing preference for mobile applications, Aidvantage launched a mobile app in 2022, extending the functionality of the portal to smartphones and tablets.

Features and Benefits

The app offers features similar to the portal, including:

- Securely accessing and viewing loan information.

- Making payments and managing payment methods.

- Updating contact information and preferences.

- Exploring repayment options and submitting requests.

- Accessing educational resources and FAQs.

Compatibility and User Experience

The app is available for Android and iOS devices, ensuring accessibility to most users.

Its design prioritizes a user-friendly interface, allowing borrowers to manage their loans conveniently on the go. The app offers additional benefits like:

Push notifications for important updates and reminders. Biometric authentication for added security. Offline access to some features for convenience.

Navient Aidvantage Settlement

While Navient reached the $1.85 billion settlement mentioned earlier, it’s important to distinguish it from Aidvantage’s own legal standing.

This settlement doesn’t directly impact Aidvantage’s services or financial processes.

However, it highlights broader issues in the student loan industry and underscores the importance of transparency and borrower protection.

Rebuilding Trust

Aidvantage acknowledges the concerns raised by the Navient lawsuit and strives to rebuild trust by:

- Implementing stricter ethical guidelines.

- Enhancing communication and transparency with borrowers.

- Advocating for fair and affordable student loan options.

Addressing Concerns

Despite efforts, concerns about student loan servicing practices persist. Borrowers can:

- Stay informed about their rights and options.

- Advocate for improved loan servicing practices.

- Consider alternative repayment plans if available.

- Seek help from financial aid advisors or legal professionals if needed.

Navient Aidvantage Log In: A Unified Journey

For borrowers managing federal student loans, a seamless login process is crucial. It unlocks access to critical information, empowers informed financial decisions, and streamlines interactions with loan servicers.

Integrating Navient and Aidvantage

In 2021, Aidvantage acquired Navient’s federal student loan servicing rights, bringing millions of borrowers under one roof.

This transition raised questions about the login experience. Thankfully, Aidvantage prioritized a unified approach:

- Single Login: All borrowers, regardless of their previous servicer, now access both Navient and Aidvantage loans through a single login on the Aidvantage Navient Portal.

- Data Consolidation: Loan information and history from both sources are consolidated within the portal, providing a holistic view of your financial standing.

- Simplifying Access: The unified login eliminates the need to remember different credentials or navigate multiple platforms, saving time and frustration.

Streamlining Financial Aid Information

This integration doesn’t just simplify login, it streamlines access to crucial financial aid information. Borrowers can now:

Understand your overall debt picture in one place. Make informed decisions about which plan best suits your financial situation.

Stay motivated and monitor your progress towards debt-free living.

Navient Aidvantage Contact Number: A Bridge to Support

Even with a user-friendly platform, questions and challenges can arise. Having clear and accessible communication channels is vital for resolving issues and getting the help you need.

Your Direct Line to Assistance

The official Aidvantage Navient contact number is 1-800-723-2773. This number connects you to a dedicated team of customer service representatives who can assist with:

Making payments and managing payment options. Understanding your loan terms and repayment plans.

Exploring hardship assistance programs. Resolving technical issues with the portal or app.

Encouraging Open Communication

Aidvantage encourages borrowers to reach out for assistance, regardless of the complexity of their question or situation. Remember:

- No question is too small: Don’t hesitate to ask for clarification or seek guidance.

- Be prepared: Gather relevant information about your loan(s) before calling.

- Be patient: Wait times can vary, so be prepared to hold for a representative.

- Take notes: Keep track of important information shared by the representative.

Transparency: Building Trust Through Openness

Open and transparent communication is key to building trust with borrowers. Aidvantage strives to achieve this by:

- Providing clear and concise information on the portal and website.

- Regularly updating borrowers about changes and important announcements.

- Making customer service representatives readily available and accessible.

- Addressing borrower concerns openly and honestly.

Conclusion

The Aidvantage Navient Portal has evolved significantly in recent years, offering a unified login experience, consolidated financial aid information, and accessible communication channels.

By understanding these features and utilizing them effectively, borrowers can confidently navigate their student loan journey and make informed financial decisions.

By staying informed about these advancements and utilizing the resources available, borrowers can leverage the Aidvantage Navient Portal as a valuable tool in achieving their financial goals.