In 2024, understanding this evolving platform is crucial for managing student debt effectively.

Let’s delve into Aidvantage’s role, its adaptation to the changing landscape, and the comprehensive services it offers.

Aidvantage in 2024: From Origins to Evolution

Emerging in 2017 as a result of the merger between PHEAA and Nelnet, Aidvantage became the leading servicer for federal student loans, managing over $550 billion in debt for millions of borrowers.

However, its role extends beyond mere servicing. Aidvantage actively strives to empower borrowers through innovative tools and resources, simplifying loan management and promoting financial well-being.

Embracing Aidvantage: Adapting to a Shifting Landscape

The landscape of student financial aid is constantly evolving, and aidvantage log in is committed to keeping pace. In 2024, several key developments underscore this commitment:

- Account Adjustment for Income-Driven Repayment (IDR) and Public Service Loan Forgiveness (PSLF): This landmark initiative, expected by July 2024, will automatically adjust payment counts for eligible borrowers, potentially putting them closer to loan forgiveness.

- Focus on Transparency and Communication: Aidvantage prioritizes clear and accessible communication through its online platform and resources, ensuring borrowers stay informed about their loans and options.

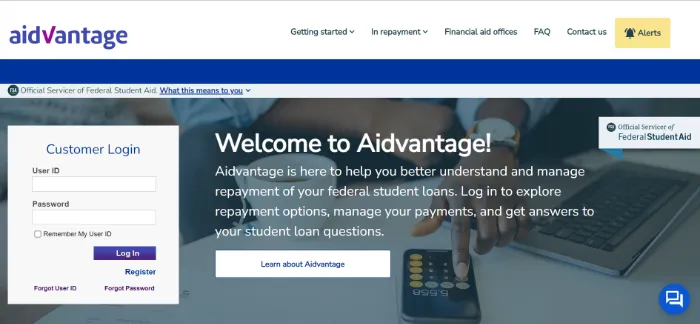

- Enhanced Online Portal: The user-friendly portal offers intuitive navigation, detailed loan information, and convenient features for managing payments, exploring repayment plans, and accessing important resources.

- Commitment to Customer Service: Aidvantage login especially prioritizes responsive customer service through multiple channels, ensuring borrowers receive timely and helpful assistance.

Aidvantage Student Loans: An Overview

Beyond the platform itself, understanding the different types of loans serviced by Aidvantage is crucial:

Direct Loans: These loans are issued directly by the Department of Education and offer various repayment options, including income-driven plans and forgiveness programs.

Federal Family Education Loan Program (FFELP) Loans: These loans are originated by private lenders but are guaranteed by the government. Aidvantage and aidvantage log in services both commercially and federally held FFELP loans.

Beyond loan types, understanding interest rates and repayment options is essential:

Interest Rates: Interest rates vary depending on loan type, disbursement date, and other factors. Aidvantage provides detailed information on its website.

Repayment Options: Aidvantage offers a wide range of repayment options, including standard, graduated, income-driven, and extended plans.

Each plan has its own advantages and disadvantages, and choosing the right one depends on your individual financial situation.

| Official Name | Aidvantage |

| Portal Type | Login |

| Language | English |

| Country | US |

| Contact Us | Call us at 800-722-1300. |

| Official login | https://www-aidvantage.com/login/ |

Aidvantage Loan Management Features

The Aidvantage login portal empowers you with an array of features to master your loan management:

1. Account Dashboard: Your personalized command center displays a clear snapshot of your financial landscape. See all loans in one place, track balances and interest rates in real time, and stay informed about upcoming payments.

Dive deeper into individual loans for detailed transaction history and payment breakdowns.

2. Streamlined Payments: Say goodbye to juggling multiple payment methods. Schedule one-time or recurring payments directly through the portal, choosing from various options like bank account transfers, debit/credit cards, or electronic checks.

Automate your payments for peace of mind and avoid late fees.

3. Repayment Plan Powerhouse: Don’t let complex repayment options overwhelm you. Aidvantage’s interactive tool guides you through a comprehensive overview of available plans, from standard and graduated to income-driven and extended.

Compare monthly payments, projected loan terms, and forgiveness eligibility criteria to make an informed decision about the plan that best aligns with your financial situation.

4. Resource Library at Your Fingertips: Download essential documents like your 1098-E tax form directly from the portal. Plus, access a treasure trove of educational resources designed to answer your loan-related questions.

5. Contact and Support Hub: Need assistance? The portal provides multiple avenues for reaching their dedicated customer service team.

Connect via phone, secure messaging, or online chat, knowing that helpful representatives are readily available to address your concerns and guide you through any challenges.

Aidvantage Services: Beyond Loan Management

Aidvantage goes beyond the usual loan servicing, offering support designed to empower your financial journey:

Deferment and Forbearance Assistance: Facing temporary financial hardship? Aidvantage understands. Their experts can guide you through available deferment and forbearance options, providing much-needed relief during challenging times.

Consolidation Simplified: Juggling multiple loans with different servicers and interest rates can be stressful. Aidvantage offers a streamlined consolidation solution, combining your loans into one easy-to-manage entity.

Public Service Loan Forgiveness (PSLF) Navigator: Are you pursuing a career in public service and dreaming of loan forgiveness? aidvantage account log in can be your trusted guide on the PSLF journey.

Teacher Loan Forgiveness Champion: Dedicated to educators? Aidvantage can help you leverage the Teacher Loan Forgiveness program. Get detailed information on eligibility requirements, qualifying teaching positions, and application procedures.

Financial Wellness Partner: Aidvantage recognizes that loan management is just one piece of your financial well-being. They offer valuable resources and tools to empower your overall financial health.

Remember: This is just a glimpse into the extensive features and services offered by Aidvantage. By actively exploring the platform and utilizing its resources, you can take control of your financial future and navigate your student loan journey with confidence.

Aidvantage Login Process & Management

If you’re new to Aidvantage, setting up an account is simple. Visit their website and click “Register Now.” Here’s what you’ll need:

- Social Security Number: This helps identify your loans and ensures data security.

- Date of Birth: Verifies your identity and confirms you’re eligible to access the account.

- Email Address: This is your primary communication channel with Aidvantage for account updates and important information.

- Contact Information: Ensure Aidvantage can reach you easily.

- Loan Information (Optional): If you have your loan servicer number or account number handy, include them to expedite the process.

Aidvantage Student Loans: Creating and Managing Your Account

Managing student loans can feel daunting, but Aidvantage simplifies the process with its user-friendly online platform.

Whether you’re new to Aidvantage or need a refresher, this comprehensive guide walks you through creating and managing your account, explaining key steps, troubleshooting tips, and best practices for secure access.

Creating Your Aidvantage Account

Before logging in, you’ll need to establish your online presence with Aidvantage. Here’s how:

1. Navigate to the Registration Page: Visit [[invalid URL removed]]([invalid URL removed]), or click “Register Now” on the Aidvantage login page.

2. Provide Necessary Information: The registration process requires details like:

| Social Security Number (SSN): Used for secure identification. |

| Date of Birth: Verifies your eligibility. |

| Email Address: Used for communication and notifications. |

| Phone Number: Optional, but enhances account security and communication. |

| Driver’s License Information: Verifies your identity and address. |

3. Create Secure Aidvantage Login Credentials: Choose a unique and strong password (mix of uppercase and lowercase letters, numbers, and symbols) and a memorable username (not your SSN).

4. Verification and Confirmation: Aidvantage may send a verification code via email or phone to confirm your information. Once verified, you’re officially an Aidvantage account holder!

The Art of Logging In

Now that your account is set up, access it seamlessly with these steps:

1. Navigate to the Aidvantage Login Page: Go to https://www-aidvantage.com/login/ or use the “Log In” button on the homepage.

2. Enter Credentials: Input your username or email address and password in the designated fields.

3. Secure Access: Opt for “Remember Me” cautiously (only on personal devices) and avoid sharing your credentials with anyone.

Troubleshooting Tips

- Forgot Username/Password: Click the respective links to recover them via email or phone.

- Incorrect Credentials: Double-check for typos and caps lock. If issues persist, contact Aidvantage support.

- Browser Issues: Ensure cookies and JavaScript are enabled. Try a different browser or clear your cache.

Security First

Protecting your account is paramount. Here are some best practices:

Strong Password: Regularly update your password and resist using the same one for multiple accounts.

Beware of Phishing: Never share your aidvantage login credentials via email or unsolicited calls. Aidvantage will never request this information through such channels.

Enable Two-Factor Authentication (2FA): This adds an extra layer of security by requiring a code from your phone or email for login.

Aidvantage Login Practices: Safeguarding Your Loan Journey

Taking charge of your student loans isn’t just about making payments; it’s about protecting your sensitive financial information.

With Aidvantage, securing your online account is crucial for peace of mind.

This comprehensive guide delves into essential security measures, troubleshooting tips, and benefits of a secure Aidvantage login.

Why Secure Aidvantage Login Matters?

A secure login unlocks a treasure trove of benefits:

- Peace of Mind: Know your financial information is protected against unauthorized access.

- Access to Exclusive Features: Securely manage your loans, explore repayment options, and stay informed about Aidvantage services.

- Financial Tracking: Monitor your loan balances, make payments, and access tax documents readily.

- Personalized Communication: Receive important updates and announcements directly in your secure account.

By prioritizing secure Aidvantage login practices and utilizing the platform’s features, you take control of your student loans and pave the way for a brighter financial future.

Aidvantage Sign In Symphony: Choose Your Tune!

Logging into your Aidvantage login page will create your account, it should be a seamless melody, not a discordant mess. Choose the method that harmonizes best with your security preferences:

- The Classic Combo: Username and password are the tried-and-true duo. Remember, create a strong, unique password to safeguard your financial information. Think complex phrases, not predictable patterns.

- The Memory Maestro: Forget remembering passwords? Security questions offer a backup melody. Choose questions only you know the answer to, like your childhood best friend’s name or your favorite vacation spot.

- The Security Serenade: Multi-Factor Authentication (MFA) adds an extra layer of security, like a duet with your phone or email. It requires a code sent to your device along with your password, creating a more robust barrier against unauthorized access.

So, whether you’re a data detective or a security maestro, Aidvantage sign in has an option that lets you manage your loans with confidence and ease.

Aidvantage Dashboard: Unveiling Your Command Center

Navigating student loans can feel like traversing a financial labyrinth. But fear not, for the Aidvantage dashboard shines as your guiding light.

Designed with clarity and intuition in mind, it empowers you to take control of your loans and make informed decisions about your financial future. Here’s a closer look at the key features waiting to be explored:

1. Loan Balances: Know Your Numbers

- Loan Breakdown: Gain instant insight into the individual balances of each loan you hold. No more hunting for information scattered across different statements.

- Progress Visualization: See how far you’ve come in your repayment journey with progress bars or charts tracking your overall loan reduction.

- Detailed Loan Information: Dive deeper into each loan by accessing details like interest rates, loan types, and disbursement dates.

2. Repayment Schedule: Stay on Top of Deadlines

- Upcoming Payment Overview: Get a crystal-clear view of your upcoming payments, including due dates, minimum amounts required, and remaining balances after each payment.

- Payment History Analysis: Trace your payment history, analyze past trends, and identify areas for improvement if needed.

- Multiple Payment Options: Explore and choose your preferred payment method – one-time, recurring, or automatic payments for ultimate convenience.

3. Deferment and Forbearance: Understanding Your Options

- Eligibility Checker: Quickly assess your eligibility for deferment or forbearance based on your specific circumstances.

- Detailed Information: Learn about the different types of deferment and forbearance available, understand their implications, and compare benefits and drawbacks.

- Application Portal: Initiate the application process directly within the dashboard if needed, saving you time and effort.

4. Alerts and Notifications: Stay Informed and Empowered

- Account Updates: Never miss a beat with notifications informing you about changes to your account details, repayment plans, or important announcements.

- Upcoming Deadlines: Receive timely reminders about upcoming payments, deferment/forbearance expiration dates, and other crucial deadlines.

- Personalized Messages: Stay in the loop with targeted messages tailored to your specific loan situation and potential benefits you might qualify for.

Exploring Repayment Options

Student loans can feel like a daunting maze, filled with confusing paths and uncertain exits. But fear not, intrepid borrower!

Aidvantage offers a range of repayment plans, each designed to be your guide and companion on your financial journey.

| Plan Name | Monthly Payment | Repayment Period | Forgiveness | Interest Cost | Analogy |

|---|---|---|---|---|---|

| Standard | Fixed | 10 years | No | Higher than income-driven plans | Scaling a steep mountain |

| Graduated | Smaller initially, increasing every 2 years | 10 years | No | Higher than Standard Plan | Climbing a gently sloping hill |

| PAYE | Based on income and family size | 20 years | Yes | Lower than Standard or Graduated Plan | Following a dynamic path |

| REPAYE | Based on income and family size | 25 years | Yes | Higher than PAYE Plan | Taking a gentler, longer path |

| IBR | Based on income and family size | 25 years | Yes | Higher than PAYE or REPAYE Plan | Walking a slightly different trail |

| ICR | Based on income and family size | 25 years | Yes | Higher than IBR Plan | Facing a challenging, unpredictable climb |

Let’s delve into the details of each option, helping you choose the one that best fits your unique needs and goals.

Standard Repayment Plan

This stalwart option offers fixed monthly payments over 10 years. Consistency and predictability are its strengths, simplifying budgeting and ensuring faster debt elimination.

However, the fixed payments prioritize quicker repayment, which may mean higher overall interest paid compared to income-driven plans.

Think of it as scaling a steep mountain – the view from the top comes sooner, but the climb can be strenuous.

Graduated Repayment Plan

Ease into your climb with this plan’s smaller initial payments that gradually increase every two years, also over 10 years. This option is ideal if you anticipate higher future income or need temporary financial flexibility.

While offering initial affordability, remember that the extended repayment period translates to more total interest paid compared to the Standard Plan.

Pay As You Earn (PAYE) Plan

This plan tailors your monthly payments to your income and family size, offering adaptability to life’s ups and downs.

After 20 years of on-time payments, the remaining loan balance may be forgiven – a sweet reward for consistent effort!

Revised Pay As You Earn (REPAYE) Plan

Similar to PAYE, this option presents a lower monthly payment but extends the forgiveness timeline to 25 years. If affordability is your primary concern, REPAYE might be your savior.

Remember, the longer repayment period means more total interest paid compared to shorter repayment plans. Consider it a gentler, longer path with a later but achievable summit.

Income-Based Repayment (IBR) Plan

Another income-driven contender, IBR offers different eligibility requirements and a 25-year forgiveness timeline. Explore this option if you don’t meet PAYE’s criteria but still seek income-based flexibility.

Remember, the trade-off for affordability is potentially higher long-term interest costs. See it as a slightly different trail through the financial landscape, leading to the same destination with different rules and scenery.

Income-Contingent Repayment (ICR) Plan

This plan bases payments on your adjusted gross income and family size, similar to the income-driven trio. However, it boasts longer repayment terms of up to 25 years and potentially higher payments compared to PAYE or IBR.

Consider this option if your income fluctuates significantly or you have high debt relative to your income. Remember, the extended repayment period and potentially higher costs require careful consideration before choosing this path.

Choosing Your Path with Aidvantage

Remember, the “right” plan depends on your unique circumstances. Consider your income, budget, career goals, and risk tolerance.

Aidvantage’s resources offer valuable information and comparison tools, but personalized guidance from a financial advisor can be invaluable.

Ultimately, choosing the right path empowers you to navigate the loan labyrinth with confidence and reach your financial summit.

So, equip yourself with knowledge, explore your options, and conquer your student loan journey with the perfect Aidvantage plan by your side!

Aidvantage Customer Service: Your Ally!

Need help navigating your account, understanding your options, or resolving issues? Aidvantage’s customer service team is there for you. Contact them through:

| Support Method | Contact Information |

|---|---|

| Phone | Call 1-800-723-2773 for personalized assistance. |

| Online Chat | Access real-time chat support directly on their website. |

| Secure Message Center | Send and receive messages within your online account. |

Remember, their team is trained to address your concerns and guide you through your financial journey. Don’t hesitate to reach out if you need help.

Aidvantage Navient Portal: A Unified Experience

For those previously served by Navient, the transition to Aidvantage might raise questions. Fear not!

The Aidvantage portal seamlessly integrates information from both platforms, ensuring a smooth and uninterrupted experience.

Your loan details, payment history, and account settings are readily accessible on a single platform, eliminating the need to juggle multiple portals.

This unification translates to improved efficiency, convenience, and a more holistic view of your financial obligations.

Aidvantage Reviews: User-Friendly Experience

The user-friendly design of the Aidvantage portal is not just a claim, it’s a reality backed by positive reviews. Users frequently praise the platform’s intuitiveness, accessibility, and ease of navigation.

Finding information, making payments, and exploring repayment options all feel effortless, putting you in control of your financial decisions.

These positive experiences contribute to building trust and confidence in the Aidvantage platform, making it a reliable partner in your loan management journey.

Aidvantage Mobile App: Convenience On-the-Go!

Life doesn’t stop, and neither should your ability to manage your loans. The Aidvantage mobile app empowers you to do just that, offering convenient access to key features right at your fingertips.

Whether you’re checking your balance during your commute, making a payment while waiting in line, or reviewing upcoming deadlines on your lunch break, the app ensures you’re always connected and informed.

Unique features like biometric login and push notifications for important updates add another layer of convenience and peace of mind.

Aidvantage Jobs: Join the Team

Are you passionate about helping others navigate the intricacies of student loan management? Consider a career with Aidvantage!

They offer various job opportunities across different departments, allowing you to contribute to their mission of providing exceptional service and empowering borrowers.

If you’re looking for a rewarding career with a purpose, exploring Aidvantage’s job listings might be the perfect next step.

Understanding Aidvantage Interest Rates

Interest rates play a crucial role in your loan repayment journey.

On the Aidvantage website, you’ll find a clear explanation of their interest rate structure, considering factors like loan type, disbursement date, and borrower profile.

The website also offers resources and tools to help you understand how these rates impact your repayment plan and explore strategies for managing interest effectively.

Aidvantage Registration: A Seamless Start

New to Aidvantage? Registering for an account is a breeze. The process is designed to be quick and simple, requiring basic information to get you started.

Once registered, you’ll gain immediate access to your loan details, repayment options, and the various features the platform offers.

Remember, registering early allows you to take control of your finances sooner and start making informed decisions about your future.

Aidvantage Contact: Support When You Need It!

Whether you have questions about your loans, need help navigating the platform, or require assistance with specific issues, Aidvantage’s dedicated support team is here to help.

You can reach them through multiple channels, including phone, online chat, and secure messaging within your online account.

Their commitment to providing prompt and accurate support ensures you never feel alone on your financial journey.

In conclusion, Aidvantage offers a comprehensive and user-friendly platform designed to empower you to manage your student loans effectively.

FAQs

Are Income-Driven Plans a Good Fit for Student Loan Repayment?

Yes, Income-Driven Plans can be a suitable option, especially if you have a low or fluctuating income. These plans offer flexibility and the potential for loan forgiveness after 20-25 years.

What Should I Do If I Miss a Payment on an Income-Driven Repayment Plan?

If you’ve missed a payment on your Income-Driven Repayment Plan, it’s crucial to take prompt action. Contact Aidvantage as soon as possible to discuss your situation. Missing payments can jeopardize your eligibility for the plan and potential loan forgiveness.

Where Can I Find More Information and Support for Student Loan Repayment?

For more information and support on student loan repayment, Aidvantage’s website is a valuable resource. It provides access to helpful tools such as calculators and frequently asked questions (FAQs). Additionally, you can contact their support team for assistance.

Conclusion

In 2024, Aidvantage login emerged, streamlining the student loan experience by merging Navient and Maximus into a single platform.

Its user-friendly portal offers easy access to loan details, empowers on-the-go management with the mobile app, and even provides career opportunities with their dedicated team.

By understanding your interest rates and registering early, you unlock a wealth of resources and support to actively manage your student loans.

Remember, Aidvantage is your partner in financial navigation – explore their services, stay informed, and take control of your future!